| Amount $ | |

|---|---|

| GST | |

| Action |

| Subtotal: | $0.00 |

|---|---|

| GST Amount: | $0.00 |

| Grand Total: | $0.00 |

How to use above GST Calculator NZ

- Add your amount on which you want to calculate GST.

- Select GST percentage, which is 15% (Pre-set).

- Select Action: Add GST or Subtract GST.

- Click on calculate and then GST converter will calculate your NZ GST.

- Boom, you will be able to see your GST amount after successfully using KIWI GST Calculator.

GST return due date

Discover the essential GST due dates in NZ tailored for businesses aligning with a March 31 balance day:

For enterprises- 2 monthly GST due dates:

- By June 28: Ful-fill April/May GST Return & Payment obligations

- By August 28: Complete June/July GST Return & Payment along with the 1st Provisional Tax Instalment Due

- By October 28: Address August/September GST Return & Payment commitments

- By January 15: Handle October/November GST Return & Payment alongside the 2nd Provisional Tax Instalment Due

- By February 28: Tend to December/January GST Return & Payment

- By April 7: Submit Terminal Tax

- By May 7: Meet February/March GST Return & Payment and the 3rd Provisional Tax Instalment Due

For businesses- 6 monthly GST due dates are:

- By October 28: Address April/September GST Return & Payment and the 1st Provisional Tax Instalment Due

- By May 7: Fulfil October/March GST Return & Payment and the 2nd Provisional Tax Instalment Due

These strategically planned due dates facilitate seamless compliance with New Zealand’s GST regulations, empowering businesses to navigate their tax obligations with confidence.

Who brought GST in New Zealand

GST was introduced in New Zealand in 1980 by Sir Roger Douglas, who was finance minister at that time. This system was introduce to increase the collection efficiency. On October 1, 1986, GST officially replaced the outdated wholesale sales tax, marking a significant milestone in New Zealand’s fiscal landscape.

How GST in New Zealand works

GST stands for Goods and Services Tax and standard GST rate stands at 15%, which got applied on various economic transactions from any retail purchase to any profession service.

How complex is to use GST Calculator New Zealand

Using GST calculator New Zealand is very easy, It is developed using short web coding which makes it more reliable, faster than competitors and it has ability to do GST calculations instantly by just one click.

GST exclusive calculator NZ

well, the calculator can do NZ GST calculations for Exclusive. It is very easy to use ADD GST or SUBTRACT GST.

New Zealand Goods and Services and How to calculate?

How to calculate NZ GST manually

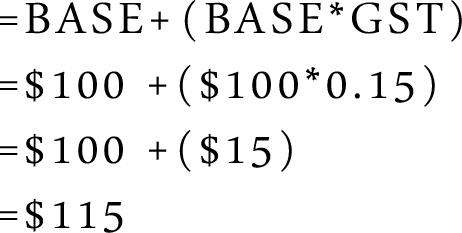

To workout GST manually, you must know what is the GST calculation formula.

[GST Amount = Original Amount × (GST Rate ÷ 100)]

Above given formula to calculate NZ GST is very clear and easy to understand, it Cleary shows the relationship between initial GST amount, Original GST amount and GST Rate.

How to register for GST NZ

If you are making over $60,000 in a period of 12 months than you have to register for GST in New Zealand. The registration process is quite easy, simply checkout this guide if you want to register.

Frequently Asked Questions (FAQs)

How much is GST in NZ ?

15% is fixed percentage of GST set by government.

How to calculate GST ?

To calculate GST, you can simply use our unique, interactive GST calculator specifically designed for KIWIs

How to work out GST in New Zealand?

A3: Use this formula to work out NZ GST.

GST-exclusive amount × 15% ( or 0.15, or 3/20 ) = GST. GST-exclusive amount × 115% ( or 0.15, 23/20 ) = GST-inclusive amount. GST-inclusive amount × 3/23 = GST.

How to get GST number in NZ ?

If you are making over $60,000 in period of 12 months then you need to have a GST registered in New Zealand and that number can be obtained from government.

How do I use a online GST calculator NZ ?

Using online GST calculator NZ is simple. Enter the pre-GST amount into the designated field, and the calculator will automatically compute the GST amount and total amount inclusive of GST.

How to calculate GST component NZ

It can be done through our NZ GST converter.

Does New Zealand have GST or VAT?

The Goods and Services Tax (GST), which is akin to Value Added Tax (VAT) in many countries, became a part of New Zealand’s tax landscape with the enactment of the GST Act on October 1, 1986.

Does New Zealand charge GST to Australia?

No, its 0%.

Can you claim GST back when leaving New Zealand?

No, you are not eligible to claim your GST back when you plan to leave NZ.

What is GST on different types of components in New Zealand

| GST on freelance work NZ | 15% |

| GST on house sale NZ | 15% |

| GST on rental income NZ | 15% |

| GST on vouchers NZ | 15% |

| GST on construction costs NZ | 15% |

| GST on sale of business NZ | 15% |

| GST on imports NZ | 15% |

| GST on income protection insurance NZ | 15% |

| GST on property settlement NZ | 15% |

| GST on rebates NZ | 15% |

| GST on research and development NZ | 15% |

| GST on vehicle purchase NZ | 15% |

| GST on air tickets NZ | 15% |

| GST on patents NZ | 15% |

| E-commerce GST NZ | 15% |

| GST Facebook ads NZ | 15% |

| GST on financial services NZ | 15% |

| GST on hire purchase NZ | 15% |

| GST on trucking NZ | 15% |

| GST on UBER or Rideshare in NZ | 15% |

Conclusion

Overall, above we have discussed about many things but most important are like how you can use our online GST calculator NZ which is specifically created to serve New Zealand audience. Moreover, we shed some light on how to work out GST or how to calculate NZ GST manually using simple formula. Furthermore, we discussed some FAQs about GST calculator NZ and then moved on to How to calculate GST components NZ.

IF you like our Specially designed, easy to use, light weight , fast Online GST calculator for New Zealand then please share it with your friends and family so they can also use it and please bookmark it for future use.