| Amount $ | |

|---|---|

| GST | |

| Action |

| Subtotal: | $0.00 |

|---|---|

| GST Amount: | $0.00 |

| Grand Total: | $0.00 |

How to use above GST calculator NZ

- Add your amount on which you want to calculate GST.

- Select GST percentage, which is 15% (Pre-set).

- Select Action: Add GST or Subtract GST.

- Click on calculate.

- Boom, you will be able to see your GST amount.

GST due dates in New Zealand

Discover the essential GST due dates in NZ tailored for businesses aligning with a March 31 balance day:

For enterprises adhering to a two-monthly GST schedule:

- By June 28: Ful-fill April/May GST Return & Payment obligations

- By August 28: Complete June/July GST Return & Payment along with the 1st Provisional Tax Instalment Due

- By October 28: Address August/September GST Return & Payment commitments

- By January 15: Handle October/November GST Return & Payment alongside the 2nd Provisional Tax Instalment Due

- By February 28: Tend to December/January GST Return & Payment

- By April 7: Submit Terminal Tax

- By May 7: Meet February/March GST Return & Payment and the 3rd Provisional Tax Instalment Due

For businesses opting for a six-monthly GST schedule:

- By October 28: Address April/September GST Return & Payment and the 1st Provisional Tax Instalment Due

- By May 7: Fulfill October/March GST Return & Payment and the 2nd Provisional Tax Instalment Due

These strategically planned due dates facilitate seamless compliance with New Zealand’s GST regulations, empowering businesses to navigate their tax obligations with confidence.

Delving into the Genesis of GST in New Zealand

The inception of GST in New Zealand traces back to the visionary reforms of the 1980s. It was Sir Roger Douglas, then Minister of Finance, who spearheaded the introduction of GST. The tax overhaul aimed to modernize the country’s tax system and enhance revenue collection efficiency. On October 1, 1986, GST officially replaced the outdated wholesale sales tax, marking a significant milestone in New Zealand’s fiscal landscape.

Understanding the Dynamics of GST in NZ

GST, an acronym for Goods and Services Tax, embodies a consumption tax levied on goods and services consumed within New Zealand. The standard GST rate stands at 15%, impacting various facets of economic transactions. From retail purchases to professional services, virtually every exchange within the country’s borders bears the GST imprint.

Navigating the Complexity with GST Calculator NZ

In a landscape characterized by intricate tax regulations, the GST calculator NZ emerges as a beacon of simplicity. Designed to streamline the computation process, this digital tool expedites GST calculations with pinpoint accuracy. By inputting the pre-GST amount, users can effortlessly derive the GST component, thereby fostering compliance and efficiency in financial transactions.

New Zealand Goods and Services and How to calculate?

The Evolution of GST Calculators in the Digital Era

With advancements in technology, GST calculator New Zealand have undergone remarkable evolution. From basic online calculators to sophisticated software solutions, businesses and individuals now have an array of tools at their disposal. These calculators not only compute GST but also offer additional features such as invoice generation and reporting, further enhancing operational efficacy.

Exploring the Mechanics of GST Calculation

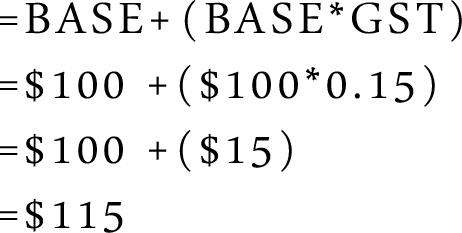

For those inclined towards manual computation, understanding the formulaic essence of GST calculation is paramount. The formula stands as follows:

[GST Amount = Original Amount × (GST Rate ÷ 100)]

This simple yet powerful equation elucidates the relationship between the original amount, GST rate, and resulting GST amount. Armed with this knowledge, individuals can navigate GST calculations with confidence and precision.

Demystifying GST Registration and Compliance

To operate within the confines of New Zealand’s tax framework, businesses must adhere to GST registration requirements. Upon surpassing the $60,000 threshold for taxable supplies within a 12-month period, registration becomes mandatory. Furthermore, businesses registered for GST can claim credits for the GST embedded in their business-related expenditures, fostering financial viability and sustainability.

Embracing Efficiency through Digital Solutions

In an era characterized by digital transformation, leveraging technology becomes imperative for businesses seeking a competitive edge. By integrating GST calculator NZ into their workflow, organizations can streamline tax-related processes, mitigate errors, and allocate resources more strategically. Moreover, the accessibility and user-friendliness of these tools democratize financial management, empowering individuals to take charge of their fiscal responsibilities.

Frequently Asked Questions (FAQs)

Q1: When should I use a GST calculator in New Zealand?

A1: GST calculators are invaluable for individuals and businesses alike when determining the GST component of transactions or invoices.

Q2: Are GST calculators accurate?

A2: Yes, GST calculators utilize the prescribed formula to ensure accurate computation of GST amounts.

Q3: Can GST calculators handle different GST rates for specific goods or services?

A3: Yes, advanced GST calculators can accommodate varying GST rates for different goods and services, providing flexibility and accuracy in calculations.

Q4: Is it possible to use a GST calculator for reverse GST calculations?

A5: Using a GST calculator is simple. Enter the pre-GST amount into the designated field, and the calculator will automatically compute the GST amount and total amount inclusive of GST.

Q5: How do I use a GST calculator in New Zealand?

A5: Using a GST calculator is simple. Enter the pre-GST amount into the designated field, and the calculator will automatically compute the GST amount and total amount inclusive of GST.

How do you calculate GST in NZ?

If you’re looking to determine the 15% GST component of a sales price that already includes GST, there are a couple of simple methods you can use. One option is to divide the total price by 1.15. Another approach involves a formula: Multiply the total sales price by 3, then divide the result by 23. This will give you the amount of GST included in the total price. These methods offer straightforward ways to calculate the GST component accurately, ensuring compliance and financial clarity.

How much is GST in NZ?

GST in New Zealand is 15%.

Does New Zealand have GST or VAT?

The Goods and Services Tax (GST), which is akin to Value Added Tax (VAT) in many countries, became a part of New Zealand’s tax landscape with the enactment of the GST Act on October 1, 1986.

Does New Zealand charge GST to Australia?

No, its 0%.

Can you claim GST back when leaving New Zealand?

No, you are not eligible to claim your GST back when you plan to leave NZ.

Conclusion: Optimizing Financial Operations with GST Calculator NZ

In the tapestry of New Zealand’s taxation landscape, the GST calculator stands as a cornerstone of efficiency and accuracy. From its inception under the stewardship of Sir Roger Douglas to its contemporary manifestation in the digital realm, GST has undergone a profound evolution.

Today, as businesses and individuals navigate the intricacies of taxation, the GST calculator NZ emerges as an indispensable ally, simplifying calculations, ensuring compliance, and fostering financial resilience.

By harnessing the power of technology and embracing innovation, stakeholders can optimize their financial operations and embark on a journey towards prosperity in the dynamic landscape of New Zealand’s economy. IF you have any issues related to GST calculator New Zealand that you can contact us here.